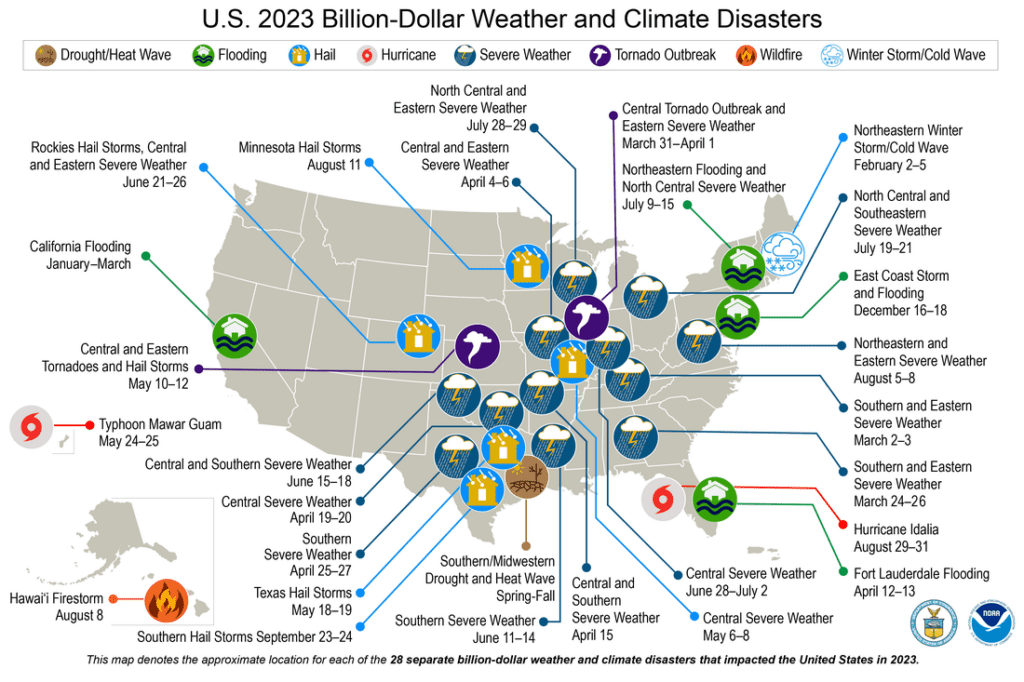

2023 Billion Dollar Disasters

Last year, the U.S. experienced 28 separate billion-dollar weather and climate disasters. Surpassing 2020 for the highest number of billion-dollar disasters in the U.S. on record.

The total cost for these 28 disasters was $92.9 billion, but that may rise by several billion dollars when the costs of the December 16-18, 2023, East Coast storm and flooding event are fully accounted for.

Why home and auto insurance rates are continuing to rise?

Thanks to an unusual convergence of market trends, ushered in by the pandemic and followed by other disruptive events, you may see a bigger change to the cost of your home and auto insurance than usual when it comes time to renew your policies this year.

Insurance rates are based on what an insurer thinks it will cost to make you whole in the event of a loss – whether it’s roof damage during a windstorm or a vehicle totaled during a traffic accident. As you’ve likely noticed, pretty much everything costs more than it did even a few years ago.

What’s driving higher home insurance costs

If you’ve shopped at Home Depot or Lowe’s lately, you’ve certainly seen that the price tags on building materials have gotten pretty expensive. Last year, the cost of building materials rose 4.7%, reflecting a particularly strong uptick in prices on things like asphalt shingles (16.2%), concrete blocks (18.5%) and drywall (20.4%).

To make matters worse, the home-building industry is facing a shortfall of more than 300,000 skilled laborers, which is driving up construction-related labor costs. Combined with the high cost of construction materials and historically low housing inventory, this has been making home claims much more expensive for insurance companies.

What’s driving higher auto insurance costs

Ongoing supply chain issues are driving a shortage of car parts and equipment, which were 22.3% more expensive at the end of 2022 than they were two years earlier. The overall cost of maintaining and repairing vehicles increased 18.4 % over the same timeframe – exacerbated by a growing shortage of car repair technicians.

The same issues depleted the supply of new and used cars during the COVID-19 pandemic, and inventories have not yet recovered. As a result, the average price of new cars has risen 20% since 2020, while used car prices have skyrocketed 37%.

Rising medical costs are another key factor. While the number of injuries and fatalities from car accidents has somewhat declined from its peak in 2021, the rising cost of medical care continues to drive higher claims costs. Between 2020 and 2022, the overall cost of medical care in the U.S. increased 6.8%

Focus on value as you explore ways to save

Keep in mind that savings come in many forms. The value of the coverage you choose today may save you more in the long run than the lowest possible premium.

Contact us to review your current coverage. We’ll help you explore opportunities for discounts that could offset higher rates when it comes time to renew.

Photo Credit: NOAA

Source: NOAA